In the USD market, US Libor loans are often negotiated on a Libor + margin basis. "Margin over CDI" is the equivalent to Libor + margin in Brazil. One should probably ask: if these two are equivalent, why do we need a post about this topic?

Answer is: although these two are equivalent, the calculation process is not.

Formula for calculating interests using "margin over CDI" follows below:

Assuming that we have a loan of 100,000 BRL at CDI + 1% and that the CDI for the first day of the loan is 11%, then the interests calculation for this first day would be:

Balance of your loan at day one: 100,045.37 BRL

Assuming that the CDI for day two is 11,25%, interests calculation should be:

Balance of your loan at day two: 100,091.66 BRL

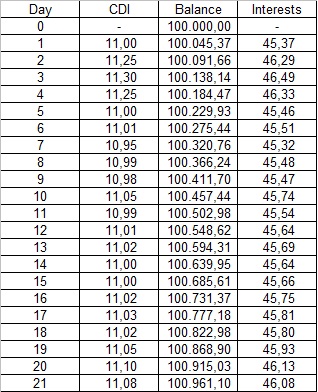

After one month (21 business days), the balance of your loan should be 100,961.10 BRL: